SCOOP: GOP sounds alarm that Biden IRS ruling is still on books and could be used to go after Trump Organization

A controversial Biden-era IRS ruling is still active — and could become a ready-made playbook for a future Democratic administration to go after the Trump Organization and other conservative-leaning businesses, Republicans are warning.

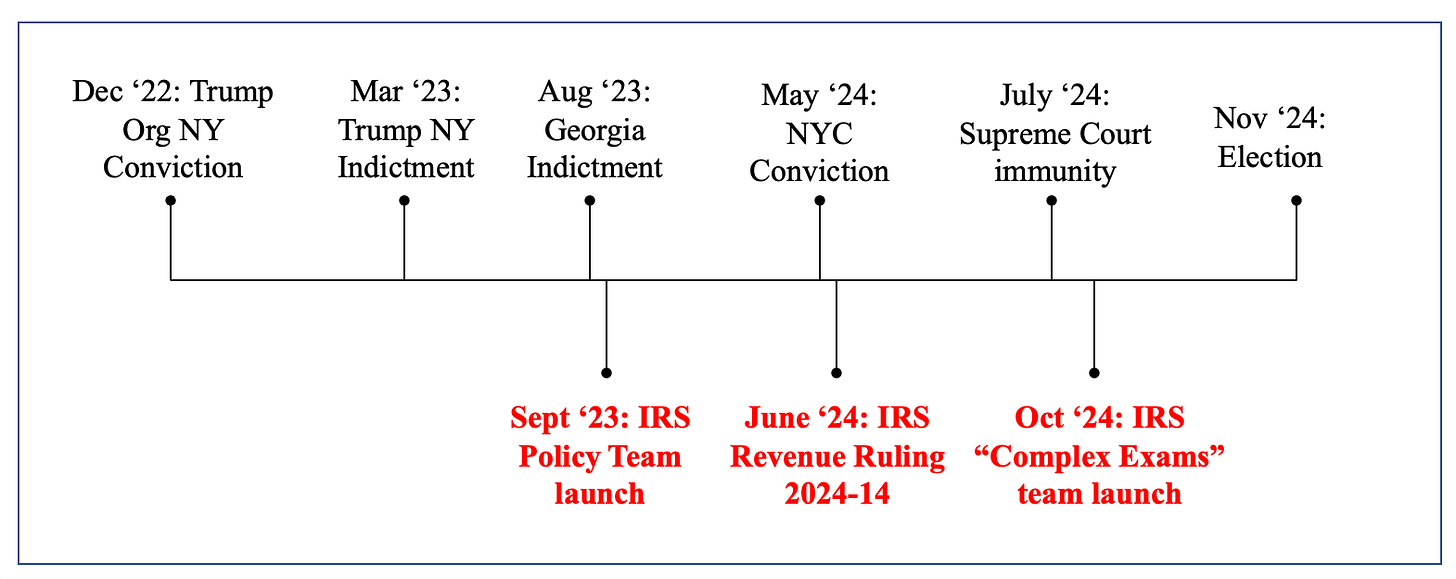

At issue is Revenue Ruling 2024-14, a dense IRS document from June 2024 that tells auditors to use the “economic substance doctrine” to wipe out tax benefits in common partnership transactions among related companies. The IRS’s work announcing the team behind the Revenue Ruling 2024-14, the launch of the ruling, and the launch of a little-reported “complex exams” team tracks closely with the legal cases against President Donald Trump and the Trump Organization.

The IRS announced the team that would lead policy work on the Revenue Ruling on September 2023 — just a few weeks after Trump’s Fulton County mugshot was released. The actual Revenue Ruling was released in June 2024 — just weeks after Trump was convicted by a New York City jury. The IRS announced another team to focus on “complex exams” — which could include the Trump Organization — in October 2024, right before the presidential election, and shortly after the Supreme Court ruled in favor of Trump’s immunity from many criminal charges, although not from the type of civil liability for the Trump Organization that the IRS could target.

The Trump administration rolled back some of the related guidance. But the core piece, this ruling, hasn’t been repealed. Republicans say the job isn’t even close to done.

“It’s still sitting there like a loaded weapon,” one GOP House aide told the Washington Reporter. “You can’t just cross your fingers and hope a future Democratic IRS commissioner doesn’t pick it up and use it to come after us. They will.”

House Republicans have kept the heat on. In a letter to IRS Commissioner Billy Long, Reps. Lloyd Smucker (R., Pa.) and Mike Kelly (R., Pa.) warned that the ruling “dramatically expands IRS authority” and “presumes any related-party activity is guilty until proven innocent.” The lawmakers said it “forces taxpayers to navigate conflicting rules” and undermines the basic stability of the tax code.

Other Republicans are blunter. Nebraska Rep. Adrian Smith, who chairs the Ways and Means Tax Subcommittee, told the Reporter the ruling reflects the same mindset behind the Lois Lerner era.

“You look back to Lois Lerner and the posture Democrats took with the IRS. It was bad then and it’s bad now,” Smith said. “Any time the IRS grabs more authority, people should be asking questions.”

A senior Senate GOP aide added that “this thing was cooked up by far-left activists looking for new ways to go after conservative businesses. If Democrats take back the White House, this is exactly the kind of thing they dust off to go after the Trump Org. They’ve been dreaming of that for years.”

Right-leaning watchdogs agree. The National Taxpayers Union urged the Treasury Department to scrap the ruling entirely, saying it turns the economic substance doctrine into a weapon, not a guardrail. The Alliance for IRS Accountability has called the ruling a “tool for IRS weaponization,” and noted that the ruling came from the same IRS division still staffed with officials tied to the 2013 targeting scandal.

As the Daily Caller’s Ashley Brasfield has previously documented, Republicans have already raised alarms about IRS personnel tied to that era, and about internal comments from IRS officials involved in the ruling who reportedly signaled they wanted to “resist” Trump. That history, conservatives say, makes leaving the ruling in place reckless.

A senior administration legal official said the White House needs to step up and act fast, before it is too late. “This isn’t some technical footnote,” the official told the Reporter. “It’s a roadmap for how a future Democratic administration could pretend they’re just ‘enforcing the code’ while targeting the President’s businesses or anyone else they don’t like. The President wants a fair system. Not this.”

Republicans say that’s why the ruling must go.

“If all you do is tweak reporting, you didn’t fix anything,” the same Senate aide said. “If Democrats win back the White House, they’ll pick up right where they left off. Unless Revenue Ruling 2024-14 is repealed, it’s sitting there waiting to be abused. They’ll use this to bankrupt and lock up Trump. Everyone knows it.”