Op-Ed: Ron Radloff and Danny Watkins Jr.: “Double drawback” is double talk and a Deep State fiction

One benefit of being from a farm community, as our members are is that you can count on your neighbors to look you in the eye, talk to you straight, and mean what they say.

Politicians, in contrast, communicate a different way: in double talk. Especially when they claim to stand up for “working people” but actually represent special interests.

We can expect Washington flimflammers to say one thing but mean the complete opposite, come up with clever tag lines to further confuse the issue, and conjure up fake statistics out of thin air.

And what do they do when we confront them with facts contradicting their doublespeak? What else? Double down.

An example of such double talk, and doubling down, was former Rep. Brad Wenstrup’s (R., Ohio) recent Washington Reporter op-ed opposing a supposed “double duty drawback” for tobacco products. Understanding why begins with recognizing what a “duty drawback” is, what it’s for, and how it works.

The duty drawback didn’t “originat(e) in Congressional actions in 1984 and 2004,” as the former representative from Ohio cynically asserts, but goes back to Alexander Hamilton (yes, that Hamilton) in 1789. The first Treasury Secretary prioritized not only creating a source of income for the new government in the form of tariffs but also helping its fledgling economy — and American workers — compete in international trade.

So, he proposed, and Congress established, a refund from tariffs, called a “drawback,” given when imported products were subsequently exported.

Over time this drawback has been amended and expanded, but its basic concept and goal of boosting American exporters — including tobacco farmers — in global markets have remained the same.

Note two features of this drawback. First, an exporter must have an import and a corresponding “American-made” product that is subsequently exported. Today, it doesn’t have to be the same product but can be a similar one, and for tobacco products it refunds excise taxes.

No export equals no drawback.

Second, the “Cardinal” rule of drawback is you cannot claim more money on an export than the amount paid into the Treasury on the import.

In other words, both in terms of the offsetting products and amounts, it’s a one-for-one deal. There’s no such thing as a “double drawback.” It’s double-talk in its purest form.

And no such thing as a “loophole drain(ing) $2.2 billion annually from American taxpayers,” as the former Congressman absurdly asserts.

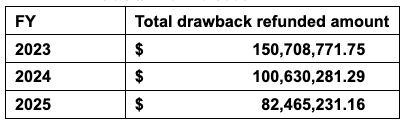

Government statistics show that taxes paid on imported cigarettes are less than $500 million per year. The table below displays the actual drawback numbers from Customs and Border Protection — not the supposed Treasury estimates:

HTSUS # 2402.20.8000- PAPER-WRAPPED CIGARETTES CONTAINING TOBACCO.

So where did the term — and the inflated drawback figures for tobacco carelessly tossed about by Mr. Wenstrup — come from? Both are Deep State fictions from a Department of Treasury lifer, who sought to double his pleasure by creating double trouble for tobacco exporters and farmers.

The phrase “double drawback” was an effort to create a rhetorical boogeyman to support regulations gutting the provision. And the $2.2 billion fabrication was forwarded to support budget “scoring” in the last administration’s “Build Back Better” bill to justify a perennial — and from a policy perspective, failed — government objective: raise taxes on tobacco.

Apparently, the staffer and his superiors believed that the Treasury Department had nothing to lose in ignoring clear Congressional intent supporting the drawback. After all, in fending off court challenges, Treasury had the full backing and deep pockets of an army of Justice Department attorneys. And only one profession is more skilled in double talk than politicians: lawyers.

Fortunately, not only did Congress see through the budget bull — BBB never passed — but both lower and appellate Courts dismissed out of hand the regulatory attempt to eliminate the drawback as an end-run around the plain text of the drawback statute and its clear purpose of supporting exporters.

Still, that’s not stopping Congressman Wenstrup, fronting for certain big tobacco interests who stand to benefit competitively if the drawback is drawn back, from doubling down by reviving the effort at the expense of struggling tobacco farmers.

Our goal is the opposite, as we watch our members become an endangered species facing not just rapidly declining use of their products and intense competition from low-priced sources abroad. But also, high duties, Value Added Tax (VAT) regimes and other trade barriers in global markets. In all, the number of tobacco farms here is down 95 percent since 2004 and production has dropped nearly three-quarters since the late 1990s.

That’s why we’re redoubling our efforts to encourage Congress and the administration to help our members throughout Tobacco Country — Virginia, Florida, North and South Carolina, Pennsylvania, Georgia, Kentucky and Tennessee — to revive their production here at home and restore their share of sales to manufacturers.

That means standing up to the double-talk of Congressman Wenstrup and his Big Tobacco allies — and preserving the same benefits Alexander Hamilton provided exporters like our members in the duty drawback at our nation’s founding.

Ron Radloff, CEO and Danny Watkins Jr., Chairman of the Board and a tobacco grower for the US Tobacco Cooperative which represents over 550 tobacco growing families in five states.